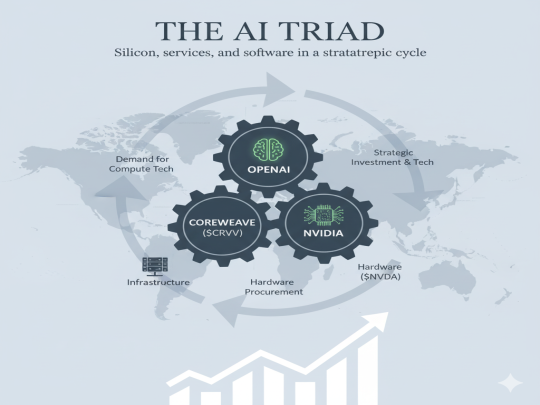

The AI Flywheel: How OpenAI, CoreWeave, and NVIDIA Fuel Each Other's Stratospheric Rise

How do OpenAI, CoreWeave, and NVIDIA fuel each other's success? Explore the symbiotic AI flywheel where demand for innovation drives a powerful and profitable cycle of growth.

In the intricate and fast-moving world of artificial intelligence, the meteoric rise of OpenAI, CoreWeave ($CRWV), and NVIDIA ($NVDA) can seem like a complex puzzle. OpenAI buys massive computing capacity from CoreWeave. CoreWeave buys the essential hardware—GPUs—from NVIDIA. And NVIDIA, in turn, invests in OpenAI. This seemingly circular flow of capital isn't a paradox; it's a powerful, self-reinforcing ecosystem—an "AI flywheel"—that is launching all three companies into the stratosphere. Let's break down how this symbiotic relationship makes perfect sense.

The Engine: NVIDIA's Unshakeable Foundation

At the very heart of this dynamic is NVIDIA. The development of advanced AI models, like those created by OpenAI, is one of the most computationally intensive tasks on the planet. It requires a specific type of hardware, the Graphics Processing Unit (GPU), and NVIDIA has a virtual monopoly on the high-performance chips needed for this work. Their GPUs are the shovels in the AI gold rush—the fundamental tools without which the entire industry would grind to a halt.

This foundational role means that any growth in AI directly translates into demand for NVIDIA's products. When a company like CoreWeave signs a multi-billion dollar deal to provide computing power, its first call is to NVIDIA to procure tens of thousands of GPUs. This insatiable demand, with long waiting lists and sky-high prices, sends NVIDIA's revenues and profit margins soaring, justifying its record-breaking stock valuations. Every new AI breakthrough is, in essence, a new advertisement for NVIDIA's hardware.

The Infrastructure Layer: CoreWeave's Crucial Bridge

This is where CoreWeave enters the picture. While NVIDIA builds the engines, CoreWeave builds the high-performance cars around them. It's an "AI Hyperscaler," a specialized cloud provider that buys GPUs from NVIDIA in bulk and builds a highly optimized infrastructure designed specifically for AI training and inference. Companies like OpenAI don't want the logistical headache of building and maintaining their own massive data centers. It's far more efficient to partner with a specialist like CoreWeave.

When OpenAI signs a landmark $22.4 billion agreement with CoreWeave, as detailed in the September 2025 announcement, it provides an enormous and predictable revenue stream for the infrastructure provider. This isn't just a one-off purchase; it's a long-term commitment that gives investors immense confidence in CoreWeave's business model and future growth. The market sees CoreWeave as a direct beneficiary of the AI boom, translating massive contracts into a surging stock price ($CRWV). It has successfully positioned itself as the essential bridge between the hardware and the innovator.

The Innovator: OpenAI's Insatiable Demand

Finally, there's OpenAI, the catalyst for this entire cycle. OpenAI's mission to build ever-more-powerful AI models creates a near-infinite demand for computing power. This demand is what initiates the flow of capital down the chain to CoreWeave and NVIDIA. OpenAI's breakthroughs capture the world's imagination and unlock new commercial possibilities, which in turn fuels its own valuation.

So why does NVIDIA invest back into OpenAI? It’s a brilliant strategic move. By providing capital to OpenAI, NVIDIA is ensuring that its most important customer segment—the AI pioneers—has the resources to keep pushing boundaries. A thriving OpenAI means more demand for advanced models, which means more demand for CoreWeave's services, and ultimately, a staggering number of future orders for NVIDIA's next generation of GPUs. NVIDIA isn’t just investing in a company; it’s investing in the continued expansion of its own market.

This flywheel effect—where innovation fuels demand for infrastructure, which fuels demand for hardware, which in turn fuels further innovation—creates a powerful and logical cycle of mutual growth. Each company's success is intrinsically linked to the others, making this trio one of the most compelling growth stories in the modern economy.