Stocks

The One Company That Quietly Owns the Future – Google

Google (Alphabet) is not just a search company. From YouTube and AI to cloud, self-driving cars, and hidden venture bets, discover why $GOOGL may be the most diversified long-term play on the future of technology

Circle Internet Group Stock Tanks Despite Stellar Revenue: Wall Street Grapples With Interest Rate Risk

Circle Internet Group stock plunged after strong Q3 earnings due to investor concerns about declining interest rates and rising operational expenses. Despite impressive USDC growth and revenue, Wall Street analysts remain divided, with upside forecasts but continued near-term valuation volatility and margin risk.

Meta’s Great Bet: When a $7.25 EPS Quarter Warrants a Sell-off

Meta's stock plunged 8% despite strong Q3 2025 revenue growth. The drop was fueled by investor alarm over the company's plan to massively increase spending on Artificial Intelligence (AI) infrastructure. This costly, long-term AI investment overshadowed its current profitability and spooked the market.

Gold’s 2025 Breakout — and Why Prices Have Now Reversed

Gold’s 2025 rally captured headlines as spot bullion pierced the $4,000/oz level amid heavy ETF inflows, central-bank buying and a wave of safe-haven demand. After that blow-off leg, prices have pulledback—sometimes sharply—on a mix of technical, macro and event-driven triggers.

All Eyes on August 4: Can Palantir’s Sky-High Valuation Survive?

Palantir’s stock has soared over 110% in 2025, driven by strong defense contracts and AI leadership. However, with extreme valuations ahead of August 4 earnings, any miss or soft guidance could trigger sharp volatility. Investors face a high-risk, high-reward setup as expectations leave little room for error.

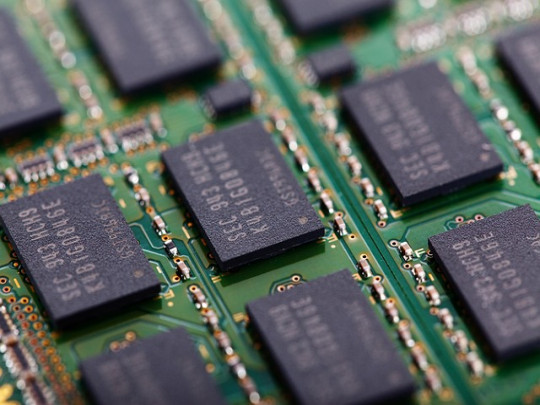

The Dutch Company Controlling the Future of AI: ASML’s Untold Story

Little-known beyond the chip world, Dutch firm ASML commands a monopoly in the machinery behind the AI revolution. Its extreme ultraviolet lithography tools—marvels of physics and engineering—have become indispensable to global computing progress. No rival is even close.

7 Large-Cap Stocks Gaining Momentum: What's Driving the Surge?

A cohort of America’s tech and financial titans is quietly rallying. Over the past month, shares in Nvidia, Oracle, AMD and others have risen sharply—each gaining more than 10%—buoyed by AI tailwinds, resilient earnings, and a renewed appetite for risk. Investors, it seems, are betting on scale, software, and silicon.

From Penny Stock to Prime Time: Cyngn’s 500% Leap After Nvidia’s Endorsement

Cyngn shares skyrocketed 500% after announcing a partnership with Nvidia to showcase its autonomous vehicles at Automatica 2025. Once facing delisting and financial struggles, Cyngn’s technology and newfound AI credibility have transformed it from a penny stock into a market sensation—though questions remain about its long-term prospects.

ASML: The Cornerstone of the AI Revolution

ASML stands alone at the heart of the AI revolution, wielding a near-monopoly over the extreme ultraviolet lithography machines essential for producing the world’s most advanced chips. This article explores how the Dutch firm’s technological prowess, robust financials, and impregnable competitive moat have made it indispensable to chipmakers and, by extension, to the future of artificial intelligence. Despite geopolitical headwinds and cyclical risks, ASML’s dominance in chipmaking machinery appears unassailable—for now.

NVIDIA in the Crosshairs: Will the AI Giant Sink or Soar Amid Global Market Turmoil?

As geopolitical tensions and market volatility surge, investors are closely watching NVIDIA’s stock for cues. This article analyzes NVIDIA's technical outlook, fundamental strengths, potential risks, and how it may react to global shocks, offering insights for navigating the storm.

Trending topics

Recent post

The One Company That Quietly Owns t...

Circle Internet Group Stock Tanks D...

Market Update: Tech Sector Retreats...

CoreWeave’s Stock Sinks as Growth M...