Stocks

The One Company That Quietly Owns the Future – Google

Google (Alphabet) is not just a search company. From YouTube and AI to cloud, self-driving cars, and hidden venture bets, discover why $GOOGL may be the most diversified long-term play on the future of technology

Circle Internet Group Stock Tanks Despite Stellar Revenue: Wall Street Grapples With Interest Rate Risk

Circle Internet Group stock plunged after strong Q3 earnings due to investor concerns about declining interest rates and rising operational expenses. Despite impressive USDC growth and revenue, Wall Street analysts remain divided, with upside forecasts but continued near-term valuation volatility and margin risk.

Market Update: Tech Sector Retreats After SoftBank's Nvidia Sale

Tech stocks dipped as SoftBank sold its entire $5.83B Nvidia stake, signaling caution despite Nvidia's strong growth. CoreWeave shares dropped 14% after lowering 2025 revenue guidance due to data center delays despite soaring Q3 revenue. The US government shutdown nears end, with markets cautious ahead of key economic data releases. Bitcoin pulled back amid mixed macro signals, while oil rose on geopolitical risks. The AI growth story remains robust, but market demands flawless execution, setting the stage for continued volatility in tech and broader markets.

CoreWeave’s Stock Sinks as Growth Momentum Shows Cracks Amid AI Infrastructure Challenges

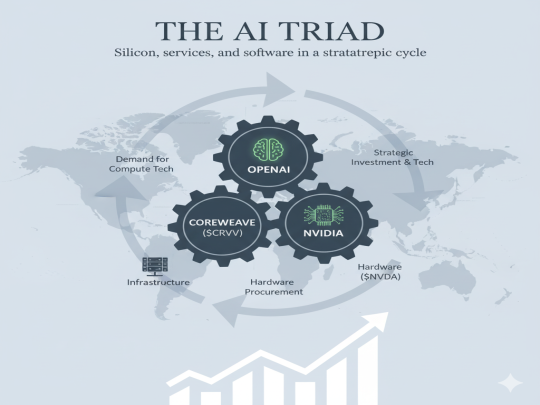

CoreWeave (CRWV) plunged 14% after cutting its 2025 revenue forecast to as low as $5.05 billion, citing construction delays at a key data center partner. The drop extends a 30% slide since late October, even as third-quarter revenue more than doubled to $1.36 billion. Rising GPU and energy costs squeezed margins, while free cash flow fell to negative $1.59 billion amid record capital spending. The stock has struggled since a $9 billion merger with Core Scientific collapsed, fueling concerns over execution and cash burn. The slump highlights cooling sentiment toward AI infrastructure plays after a year of explosive gains.

Meta’s Great Bet: When a $7.25 EPS Quarter Warrants a Sell-off

Meta's stock plunged 8% despite strong Q3 2025 revenue growth. The drop was fueled by investor alarm over the company's plan to massively increase spending on Artificial Intelligence (AI) infrastructure. This costly, long-term AI investment overshadowed its current profitability and spooked the market.

The Trump-Xi Dance Sends Asian Markets Plunging Ahead of JPM, Goldman Earnings

Beijing's surprise sanctions on Hanwha Ocean have rekindled the trade war, sending Asian indices plunging (Hang Seng TECH: −3.65%). This geopolitical gambit, a direct counter to a U.S. maritime probe, plunges global markets into uncertainty. Attention now pivots to U.S. financial earnings—a crucial test of whether corporate results can outweigh escalating Sino-American brinkmanship.

China’s Rare-Earth Clampdown

Beijing has dramatically expanded export controls on rare-earth elements (REEs), processing technologies and downstream products. The move immediately jolted markets and stocks — Chinese producers rose, U.S. and allied critical-minerals names rallied — and has forced a strategic re-think across the global supply chain. For industry participants — miners, processors, magnet makers, OEMs in the EV/wind/aerospace sectors, recyclers and equipment suppliers — the implications are profound: a rush to onshore capability, a likely multi-year investment cycle, shifts in trade patterns, and a new premium on technical know-how, traceability and environmental compliance.

Gold’s 2025 Breakout — and Why Prices Have Now Reversed

Gold’s 2025 rally captured headlines as spot bullion pierced the $4,000/oz level amid heavy ETF inflows, central-bank buying and a wave of safe-haven demand. After that blow-off leg, prices have pulledback—sometimes sharply—on a mix of technical, macro and event-driven triggers.

The AI Flywheel: How OpenAI, CoreWeave, and NVIDIA Fuel Each Other's Stratospheric Rise

How do OpenAI, CoreWeave, and NVIDIA fuel each other's success? Explore the symbiotic AI flywheel where demand for innovation drives a powerful and profitable cycle of growth.

Fed cuts rates; Trump to Powell: "Cut 100 points or you're FIRED!"

On September 17, 2025, the Federal Reserve enacted a quarter-percentage-point interest rate cut, citing moderating economic growth and rising risks to employment. This decision prompted a swift and aggressive response from Donald J. Trump. In a social media post, Trump called the rate cut "TINY" and Federal Reserve Chair Jerome Powell a "Total idiot!!!". He demanded a more substantial 100-basis-point cut at the next meeting, threatening Powell's job if his demand was not met. The exchange is detailed in the provided press releases and tweet.

Trending topics

Recent post

The One Company That Quietly Owns t...

Circle Internet Group Stock Tanks D...

Market Update: Tech Sector Retreats...

CoreWeave’s Stock Sinks as Growth M...