ASML: The Cornerstone of the AI Revolution

ASML stands alone at the heart of the AI revolution, wielding a near-monopoly over the extreme ultraviolet lithography machines essential for producing the world’s most advanced chips. This article explores how the Dutch firm’s technological prowess, robust financials, and impregnable competitive moat have made it indispensable to chipmakers and, by extension, to the future of artificial intelligence. Despite geopolitical headwinds and cyclical risks, ASML’s dominance in chipmaking machinery appears unassailable—for now.

How a Dutch Giant’s Lithography Monopoly Powers the World’s Most Advanced Chips

Market Dominance: The EUV Imperium

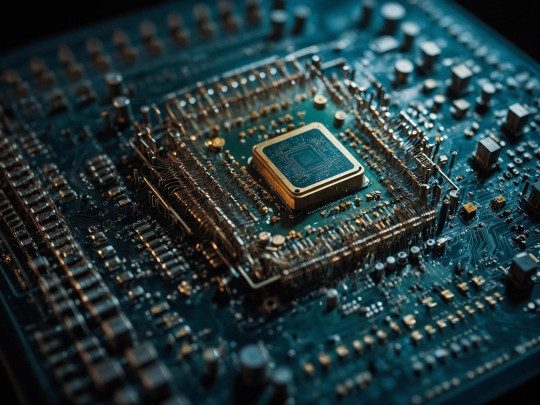

ASML holds a 100% market share in the Extreme Ultraviolet (EUV) lithography space—an $11.5 billion cornerstone of modern chip manufacturing. These advanced systems are essential for producing sub-5nm semiconductors, which power AI accelerators, data centers, and autonomous technologies. This dominance is not incidental; it’s the result of nearly two decades of focused innovation and a €6 billion research and development effort.

Each EUV machine comprises over 100,000 intricate components, a complexity so formidable that competitors like Nikon and Canon have effectively exited the EUV race. In the ongoing arms race to develop ever more advanced chips, ASML’s technology has become indispensable. It is not merely a vendor—it is an enabler of progress across nearly every frontier of modern computing.

Financial Fortitude: Engineering Profitability

ASML’s financial performance over recent years mirrors the rapid acceleration in demand for AI-ready semiconductors. Revenues have surged from €18.6 billion in 2021 to €28.26 billion in 2024, while annual R&D spending consistently exceeds €4.3 billion. The company’s robust execution is reflected in key financial metrics:

At the end of 2023, ASML held a €39 billion order backlog—equivalent to 1.5 years’ worth of revenue—signaling strong forward visibility. Shareholders received nearly €3 billion in 2024 via dividends and share buybacks, highlighting the firm’s capital return strength.

Competitive Landscape: A Solitary Peak

The EUV Void

- Nikon and Canon remain limited to deep ultraviolet (DUV) lithography, holding a combined 20% of that shrinking segment. Canon’s exploration of nano-imprint lithography (NIL) is yet to prove scalable for leading-edge production.

- Applied Materials and Lam Research offer complementary tools such as etching and deposition systems, but they do not compete directly in the lithography space.

Customers as Captives

Chipmakers such as TSMC, Intel, and Samsung invest billions annually in ASML machines to retain technological leadership. Their fabrication plants are optimized specifically for ASML’s systems, creating an effective lock-in that discourages switching or diversifying away.

Geopolitical Shields

Western export restrictions currently prevent ASML from supplying advanced EUV systems to China. While this limits access to a potentially lucrative market, it simultaneously hampers the development of any serious China-based challenger. In effect, these controls help preserve ASML’s lead across the rest of the global market.

The Unassailable Moat: Why Rivals Can’t Catch Up

- Technological Chasm: Each EUV machine relies on optics with sub-atomic precision, manufactured exclusively by Carl Zeiss SMT in Germany. The cost per unit can reach $370 million, and replicating this ecosystem would require decades and tens of billions in capital.

- Intellectual Property Fortress: With over 15,000 patents, ASML protects core technologies like High-NA EUV, which will enable the next leap to 2nm semiconductor processes.

- Pricing Power: With no viable alternatives, ASML maintains gross margins exceeding 50%, a rare feat in high-tech capital equipment.

- Customer Symbiosis: ASML collaborates closely with key clients like TSMC, Intel, and Samsung in co-developing next-generation lithography systems. This strategic integration makes ASML a permanent fixture in their innovation pipelines.

“ASML isn’t selling machines—it’s selling the future of computing.”

— Semiconductor Industry Analyst

Future Outlook: The High-NA Horizon

Growth Catalysts

- AI Demand Explosion: Next-generation AI models, such as GPT-6 and beyond, will demand chips at 3nm and smaller nodes. These are only achievable using ASML’s upcoming High-NA EUV systems.

- 2030 Vision: Industry forecasts project ASML’s revenue to grow to between €44 and €60 billion by the end of the decade, largely driven by the adoption of High-NA tools, which command a 40% premium over current-generation EUV machines.

- Vertical Expansion: Governments in the U.S. and European Union are funding large-scale semiconductor fabrication projects where ASML’s tools are essential. Chipmakers like Intel are integrating these machines into their new “mega-fabs,” further embedding ASML into the supply chain.

Risks in the Lithography Lens

- Customer Concentration: TSMC, Samsung, and Intel contribute to over 65% of ASML’s revenue. Any cutback in capital expenditure from these clients would directly impact growth.

- Cyclicality: While ASML remains fundamentally strong, the semiconductor industry is inherently cyclical. The modest growth from €27.56 billion in 2023 to €28.26 billion in 2024 reflects temporary slowdowns due to inventory corrections.

- Geopolitical Uncertainty: Rising tensions in the global tech cold war, especially between the U.S. and China, pose risks to both supply chains and market access.

Conclusion: The Invisible Colossus

ASML’s dominance in EUV lithography represents one of modern industry’s most unshakeable monopolies. Its machines don’t just etch silicon—they enable the AI era itself. While cyclical headwinds and geopolitical tensions pose challenges, the company’s technological moat, pricing power, and alignment with AI’s exponential growth trajectory make it irreplaceable. As NVIDIA builds trillion-parameter neural networks and Apple embeds AI into every iPhone, remember: all of it starts in a Dutch clean room, where light is shaped into the future