The CoreQuant

- An editor at The CoreQuant

- New York

I believe in the transformative power of storytelling. Every article I write is an opportunity to connect with you, to share a piece of my world, and to inspire you to see things from a new perspective. Whether it’s through a heartfelt personal essay or a deep dive into a trending topic, my aim is to create content that leaves a lasting impact.

The Latest from The CoreQuant

Stock Market Update: Levi Strauss Soars, Bitcoin Hits New Highs, Trump Tariffs Hit Canada and Shake Markets

Stock Market Update: Levi Strauss jumped on strong earnings and guidance. Bitcoin and Ether surged to record highs amid ETF inflows. Trump’s 35% Canada tariff rattled iShares Canada ETF, Cameco, and TD Bank. AMC and Performance Food Group also made big moves.

Stock Market Update: Tesla Slides, Solar Stocks Sink, and Tariff Turmoil Weighs on Wall Street

Stock Market Update: Tesla tumbled after Elon Musk launched a new political party, while Sunrun, First Solar, and Enphase fell on rollback of green energy subsidies. JPMorgan, Goldman Sachs, and BofA dipped post-downgrades. Vertiv and Chemours gained.

Stock Market Update: S&P 500 and Nasdaq Hit Fresh Highs as Nvidia, Moderna, and Coinbase Lead the Charge

Stock Market Update: S&P 500 and Nasdaq reached record highs with strong gains in Nvidia, Microsoft, and Coinbase. Moderna surged after flu vaccine data, while Tesla dipped ahead of delivery numbers. Walt Disney, Oracle, and Kratos also rallied on upgrades.

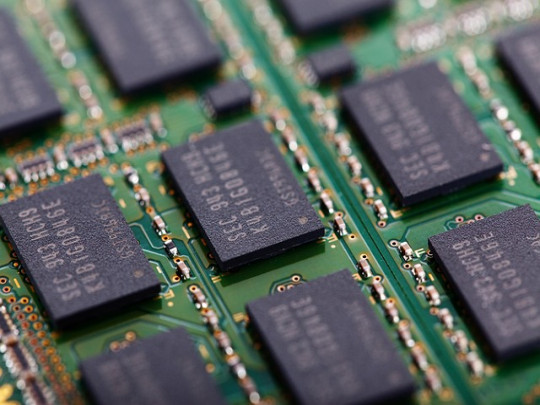

The Dutch Company Controlling the Future of AI: ASML’s Untold Story

Little-known beyond the chip world, Dutch firm ASML commands a monopoly in the machinery behind the AI revolution. Its extreme ultraviolet lithography tools—marvels of physics and engineering—have become indispensable to global computing progress. No rival is even close.

7 Large-Cap Stocks Gaining Momentum: What's Driving the Surge?

A cohort of America’s tech and financial titans is quietly rallying. Over the past month, shares in Nvidia, Oracle, AMD and others have risen sharply—each gaining more than 10%—buoyed by AI tailwinds, resilient earnings, and a renewed appetite for risk. Investors, it seems, are betting on scale, software, and silicon.

From Penny Stock to Prime Time: Cyngn’s 500% Leap After Nvidia’s Endorsement

Cyngn shares skyrocketed 500% after announcing a partnership with Nvidia to showcase its autonomous vehicles at Automatica 2025. Once facing delisting and financial struggles, Cyngn’s technology and newfound AI credibility have transformed it from a penny stock into a market sensation—though questions remain about its long-term prospects.

ASML: The Cornerstone of the AI Revolution

ASML stands alone at the heart of the AI revolution, wielding a near-monopoly over the extreme ultraviolet lithography machines essential for producing the world’s most advanced chips. This article explores how the Dutch firm’s technological prowess, robust financials, and impregnable competitive moat have made it indispensable to chipmakers and, by extension, to the future of artificial intelligence. Despite geopolitical headwinds and cyclical risks, ASML’s dominance in chipmaking machinery appears unassailable—for now.

Market Summary: S&P 500 and Nasdaq Reach Record Highs Amid AI Optimism and Fed Rate Cut Hopes

The S&P 500 and Nasdaq closed at record highs, fueled by optimism over artificial intelligence, strong corporate earnings, and expectations of Federal Reserve rate cuts. Despite recent volatility and ongoing policy uncertainties, the market has shown remarkable resilience, with tech and consumer sectors leading the rally. Easing trade tensions and a drop in market volatility have further boosted investor confidence as the outlook for AI and monetary policy continues to drive gains.