Stocks

7 Large-Cap Stocks Gaining Momentum: What's Driving the Surge?

A cohort of America’s tech and financial titans is quietly rallying. Over the past month, shares in Nvidia, Oracle, AMD and others have risen sharply—each gaining more than 10%—buoyed by AI tailwinds, resilient earnings, and a renewed appetite for risk. Investors, it seems, are betting on scale, software, and silicon.

From Penny Stock to Prime Time: Cyngn’s 500% Leap After Nvidia’s Endorsement

Cyngn shares skyrocketed 500% after announcing a partnership with Nvidia to showcase its autonomous vehicles at Automatica 2025. Once facing delisting and financial struggles, Cyngn’s technology and newfound AI credibility have transformed it from a penny stock into a market sensation—though questions remain about its long-term prospects.

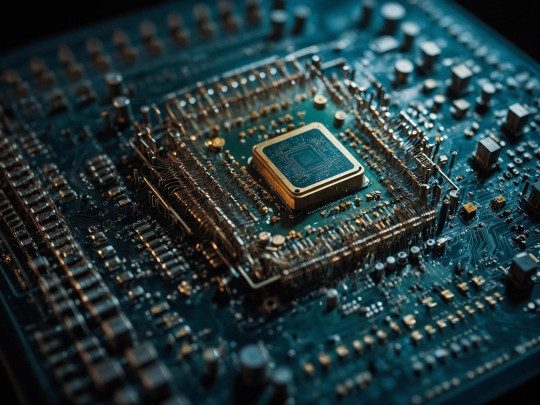

ASML: The Cornerstone of the AI Revolution

ASML stands alone at the heart of the AI revolution, wielding a near-monopoly over the extreme ultraviolet lithography machines essential for producing the world’s most advanced chips. This article explores how the Dutch firm’s technological prowess, robust financials, and impregnable competitive moat have made it indispensable to chipmakers and, by extension, to the future of artificial intelligence. Despite geopolitical headwinds and cyclical risks, ASML’s dominance in chipmaking machinery appears unassailable—for now.

Market Summary: S&P 500 and Nasdaq Reach Record Highs Amid AI Optimism and Fed Rate Cut Hopes

The S&P 500 and Nasdaq closed at record highs, fueled by optimism over artificial intelligence, strong corporate earnings, and expectations of Federal Reserve rate cuts. Despite recent volatility and ongoing policy uncertainties, the market has shown remarkable resilience, with tech and consumer sectors leading the rally. Easing trade tensions and a drop in market volatility have further boosted investor confidence as the outlook for AI and monetary policy continues to drive gains.

Stock Market Update: S&P 500 Nears Record Highs as Nike Soars, Tesla Shakes Up Leadership, Tariff Fears Ease

Stock Market Update: S&P 500 inches toward new highs as Nike jumps post-earnings, Core Scientific rallies on buyout talks, and AeroVironment extends its surge. Tesla ousts top exec amid sales woes. Trade optimism grows after U.S.-China framework.

Stock Market Update: S&P 500 Stalls Near Record Highs, FedEx Slumps, Coinbase and BlackBerry Rally

Stock Market Update: S&P 500 futures flat as investors await Powell's comments. FedEx drops after cautious outlook, while Coinbase jumps on bullish call. BlackBerry rallies post-earnings. Oil edges higher as ceasefire holds, QuantumScape soars on tech milestone.

From War to Whiplash: Trump’s Israel-Iran Deal Rattles Markets

A dramatic escalation in the Israel-Iran conflict saw U.S. strikes on Iranian nuclear sites, followed by Iranian retaliation and urgent diplomacy led by Qatar and President Trump. Trump’s unexpected ceasefire announcement prompted an immediate 8% plunge in both oil prices and the VIX, demonstrating the profound influence of geopolitical developments on global markets.

Market Update: U.S. Strikes on Iran Spark Global Tension, Defense Stocks Gain, Gold and Oil Hold Steady

Stock Market Update: U.S. airstrikes on Iran's nuclear sites rattle geopolitics but markets stay calm. Oil and energy stocks like Exxon, Marathon, and Conoco rise. Defense names RTX and Northrop tick up. Novo Nordisk slumps, Circle rallies again.

Will Oil Prices Hit $100 per Barrel? 2025 Outlook Amid Geopolitical Tensions

Oil prices are facing renewed upward pressure amid rising Middle East tensions, especially after U.S. strikes on Iranian nuclear facilities. The potential disruption of the Strait of Hormuz, through which 20% of global oil flows, has added a geopolitical risk premium. However, most forecasts—including J.P. Morgan and Goldman Sachs—do not see Brent crude sustaining $100 per barrel in 2025. Analysts cite moderate demand, sufficient supply buffers, and OPEC+ spare capacity. Still, a severe conflict or prolonged supply shock could temporarily drive prices above $100. While not the base case, the risk of a sharp spike in oil prices remains.

Strait of Hormuz Crisis: Iran's Bold Move Signals Global Oil Risk as Ship’s Sudden Turn Sparks Alarm

Iran’s parliament votes to close the Strait of Hormuz after U.S. strikes on nuclear sites, risking disruption of 20% of global oil supply. A ship’s sudden turn sparks fears of escalation. Here’s what it means for global markets and security.

Trending topics

Recent post

The One Company That Quietly Owns t...

Circle Internet Group Stock Tanks D...

Market Update: Tech Sector Retreats...

CoreWeave’s Stock Sinks as Growth M...